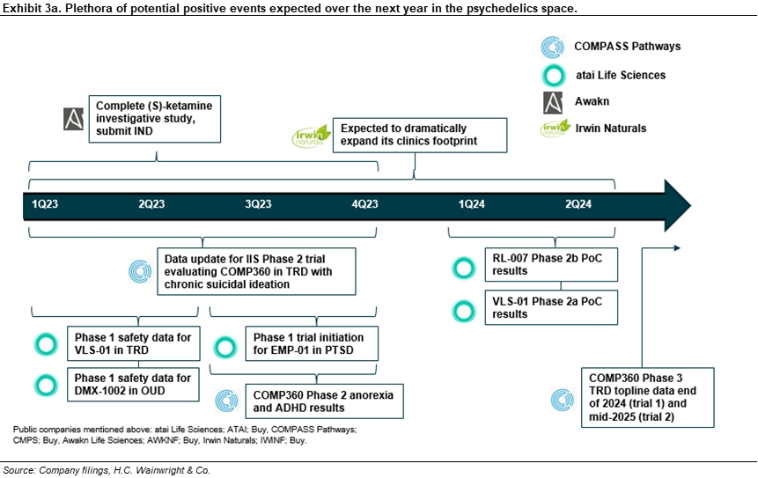

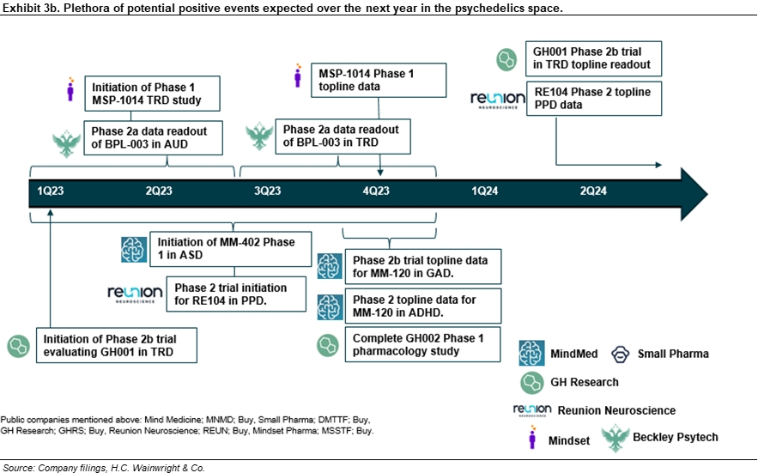

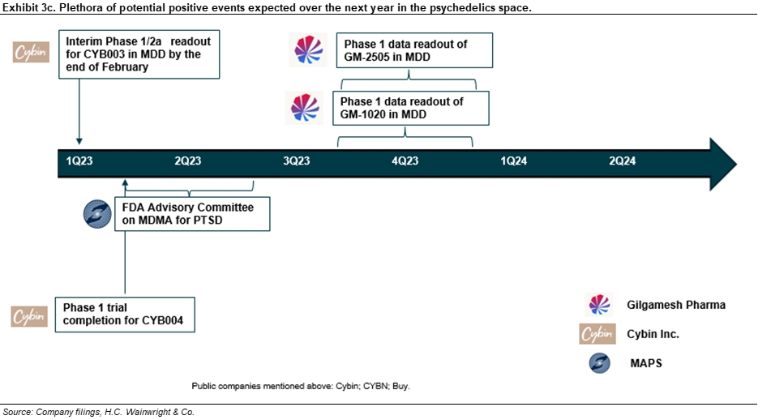

Managements in the neuropharmaceutical psychedelics space are upbeat ahead of near-term catalysts. Earlier this month, we met with most of the managements in our coverage universe of companies pursuing psychoactive agents for various mood disorders such as depression, anxiety, and post-traumatic stress disorder (PTSD), among others. Collectively, the teams expressed optimism regarding their lead compounds and the broader focus on improving mental health outcomes worldwide, which should place greater emphasis on evidence in the literature (e.g., Goodwin, Aaronson, et al., 2022) that appears to point to the potential of psychoactive agents. Against this bullish backdrop and even following recent compelling data releases, we believe the space continues to be underappreciated by investors owing to several concerns, including: (1) managerial expertise, particularly in the area of drug development; (2) intellectual property protection, particularly for the first generation compounds where patent cliffs are being modeled far earlier than our expectations; (3) regulatory risk, particularly around the potential need for therapy or support along with treatment, and how the FDA and European Medicines Agency (EMA) are to view such need in review of data packages; and (4) a perception of a mental healthcare infrastructure presently underdeveloped in the administration of psychoactive medicines, which may hinder uptake upon potential approvals; and (5) the risk from emerging non-psychedelic compounds that could preclude the need for psychedelic experiences, undercutting long-term potential of psychoactive compounds. We believe each of these concerns has been or is being addressed by the companies in the space, and that the data readouts as well as regulatory feedback expected over the next year (see Exhibit 3), together with a robust buildout of the mental health clinic infrastructure, should help drive the space, unlocking substantial shareholder value over t

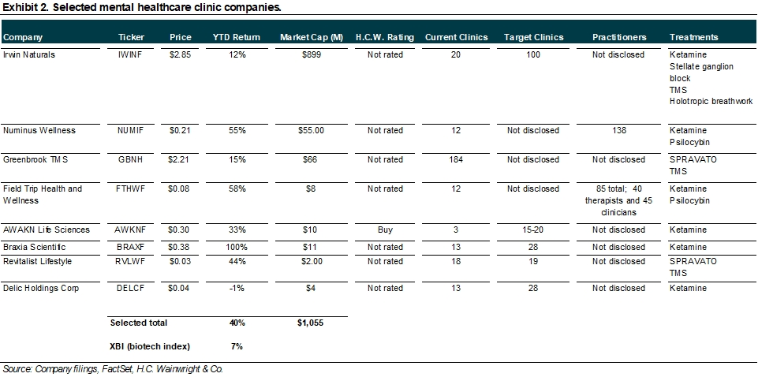

Irwin Naturals; IWINF; Buy; $5 price target. Irwin Naturals, through Emergence, is in the early stages of a large-scale national acquisition of mental health clinics initially offering ketamine-assisted psychedelic therapy (KAP) treatments to patients suffering from mental health issues and other ailments. Over the past several months, Emergence has vetted the more than 600 independent ketamine clinics currently operating in the U.S., seeking to identify profitable clinics that practice the standard of customer care consistent with the Irwin Naturals brand. Once identified, those clinics are invited to join Emergence, which in return is offering share ownership in Irwin Naturals, as well as potential cash milestone payments in the future. Emergence intends to expand treatment options at the clinics; initially offering ketamine with therapy, we believe potential FDA approvals of additional psychedelics in a broad range of mental health disorders could meaningfully expand the offerings at Emergence clinics, underpinning a market that could approach revenues of $200B annually, by our estimates. Throughout 2023, we expect Irwin to expand its clinic business the U.S. following recently announced deals that have closed or are near closing and expected to add clinics across Florida, Washington, and Kentucky. Separately, and interestingly, on January 10, Irwin announced a partnership with Braxia Scientific (BRAXF; not rated) for in-human clinical studies supporting pharmaceutical companies in the U.S. The partnership aims to bring together Braxia’s expertise and clinical research capabilities to 12 of Irwin’s Emergence clinics in five U.S states. Irwin is expected to invest up to $2M over the next 12 months to launch initial clinical research services beginning with at least five clinics in Florida. We believe the Braxia deal should contribute to Irwin’s success in not only attracting additional clinics to Emergence’s fold, though also providing those clinics with expertise needed to administer psychoactive compounds. Our Irwin model includes 25 Emergence clinics in 2022 that expand to 75 Emergence clinics in 2023, 125 in 2024, and 175 in 2025. We estimate that the number of Emergence clinics could exceed 300 at peak, generating annual revenues of $1B-plus. We estimate cash flows from this business are worth approximately $1.5B or $3/ share (60% of total IWINF valuation). For additional details, refer to our October 3 2022 initiation of coverage report entitled Ambitious Expansion in Psychedelic Healthcare Market Underway; Initiating With a Buy and $5 Price Target.

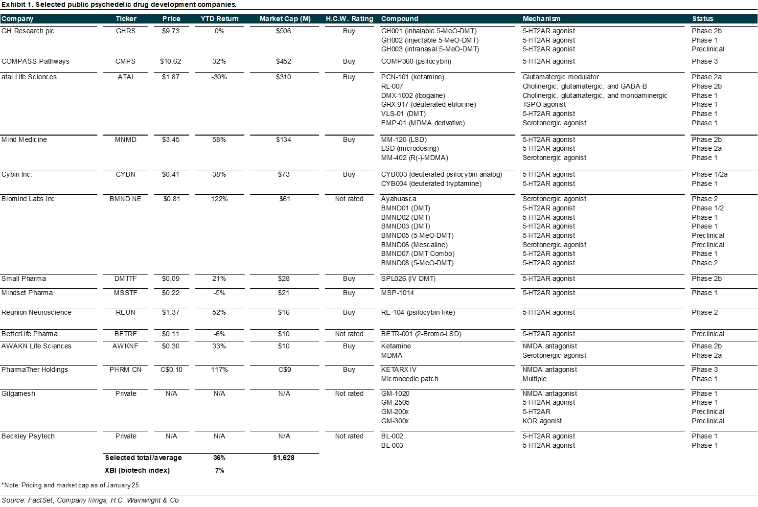

GH Research; GHRS; Buy; $45 price target. GH Research ended 3Q22 with approximately $257M in cash and cash equivalents. Lead candidate GH001, an inhalable form of 5-Methoxy-DMT (5-MeO-DMT), a short-acting psychoactive agent delivered via a vaporization device, has completed two Phase 1 trials in healthy volunteers and a Phase 2 trial (GH001-TRD-102) in patients with treatment-resistant depression (TRD). To date, clinical results have demonstrated that GH001 is well tolerated at the investigated single dose levels and in an individualized dosing regimen (IDR) with intra-subject dose escalation within a single day. Recall that the primary endpoint of Part B of the Phase 2 portion of the Phase 1/2 trial was defined as the proportion of patients in remission on day seven after dosing, defined as a Montgomery–Åsberg Depression Rating Scale (MADRS) total score of less than or equal to 10, with the MADRS depression scale being the gold standard measure for efficacy in studies evaluating novel antidepressants. This primary endpoint was met with seven of eight patients (87.5%) achieving a MADRS remission on day seven (p<0.0001). Of those seven patients, all were in remission beginning on day one, with five in remission as early as two hours after dosing. All seven patients with a remission on day seven also achieved a MADRS clinical response, defined as a reduction of 50% or more from baseline in the MADRS total score, whereas the remaining patient also exhibited improvement on the basis of the MADRS scale on day seven compared to baseline, but did not achieve a MADRS remission or MADRS clinical response. The mean MADRS change from baseline at day seven, a secondary endpoint, was -24.4 (-76%). GH has submitted clinical trial agreements (CTAs) in several European countries to conduct a multi-center, randomized, controlled Phase 2b trial evaluating GH001 in TRD (GH001-TRD-201); pending regulatory approval, GH expects to initiate this study in 1Q23. GH intends to recruit approximately 80 patients for the trial; the primary objective is to determine the efficacy of a single-day IDR of GH001 compared with placebo in improving depressive symptoms as assessed by the mean change from baseline in the MADRS at the end of the 7-day double-blind phase; we would anticipate top-line data from the trial in 2024. GH has also initiated the following trials with GH001: (1) a Phase 2a proof-of-concept trial evaluating safety and efficacy in patients with bipolar depression II (BPII) and a current depressive episode; and (2) a Phase 2a proof-of-concept trial evaluating safety and efficacy in patients with post-partum-depression (PPD). In addition, GH intends to conduct a Phase 1 imaging study expected to be conducted in the U.S. in patients with TRD designed to further elucidate the mechanism of action of GH001. Separately, a Phase 1 trial evaluating GH002, an injectable 5-MeO-DMT candidate, is expected to complete in 4Q23. Broadly, we are confident in GH Research’s drug candidates across neuropsychiatric indications, and we believe they are underappreciated by investors. For additional details, refer to our August 16 2022 initiation of coverage report entitled Deep Breath Hold Tight; Rapid-Acting Antidepressant Program Progressing; Initiating With a Buy and $45 Price Target.

COMPASS Pathways; CMPS; Buy; $120 price target. COMPASS ended 3Q22 with approximately $173M in cash and cash equivalents. Recruitment in a Phase 3 program evaluating COMP360, an oral formulation of psilocybin, in approximately 946 patients with TRD is underway. The program is to be conducted across 150 sites in 14 countries, expected to begin in 1Q23. Two parallel studies are expected to include: (1) a single 25 mg COMP360 dose vs. placebo (psychological support) in COMP 005; and (2) a fixed repeat dose in COMP 006 to evaluate 1 mg COMP360, 10 mg COMP360, and 25 mg COMP360 with psychological support in COMP006. The primary endpoint for both pivotal studies, the change from baseline in the MADRS total score, is expected to be evaluated at Week 6. COMP005 is expected to enroll 378 TRD patients randomized 2:1 to receive 25 mg COMP360 or placebo at the beginning of the study with top-line data expected by the end of 2024, while COMP006 is expected to enroll 568 TRD patients randomized 2:1:1 to receive 25 mg COMP360, 10 mg COMP360, or 1 mg COMP360, respectively, with top-line data expected in mid-2025. Interestingly, and in a change from the Phase 2b program, COMP006 includes a repeat dose at Week 3, which we believe could improve patient response rates, and may demonstrate potential for efficacy at the lower 10 mg dose. Separately, on October 12, COMPASS announced that the COMP 401 trial evaluating COMP360 in patients with anorexia nervosa is ongoing with an expected completion date in August 2023. Based on the initial outcome from an academic study, we believe that COMP 401 could generate positive results, something which is not appreciated by investors based on CMPS’ current valuation, in our view. In addition, the COMP 201 trial evaluating COMP360 in PTSD is expected to complete by the end of 2023. While we believe COMP360 has potential in PTSD, we believe the compelling data generated in an investigator-initiated study (IIS) with COMP360 in BPII may instead lead management to pursue an indication in bipolar depression. For additional details, refer to our December 9 note entitled Several Studies Presented Including Data Pointing to the Potential for Psychedelics in Bipolar Depression; Reiterate Buy.

Atai Life Sciences; ATAI; Buy; $20 price target. atai ended 3Q22 with $304M in cash and investments. In 1H23, we expect Phase 1 safety data for DMX-1002, an ibogaine candidate, in opioid use disorder (OUD). Also in 1H23, we anticipate the last patient to be dosed in Cohort 3 in the single-ascending dose (SAD) portion of the Phase 1 trial evaluating DMX-1002. Additionally, top-line data is expected in the Phase 1 trial evaluating EMP-01, an MDMA derivative, in mid-2023. VLS-01, an N,N-Dimethyltryptamine (DMT) candidate, is expected to generate pharmacokinetic (PK) and safety data from a Phase 1 trial in 1H23. In particular, we believe the behavioral assessments together with the PK and safety readouts should demonstrate that VLS-01 is well-tolerated with an acceptable safety profile. Further, we believe VLS-01 is among atai’s most promising assets moving forward following the disappointing top-line data that was recently reported from a Phase 2a trial that evaluated PCN-101, an R-ketamine candidate, in patients with TRD. Separately, on January 9, atai announced Phase 1 data that showed GRX-917, a deuterated etifoxine, was well tolerated with sedation comparable to that of the placebo. In addition, the trial demonstrated target engagement via a dose-related activation of quantitative electroencephalography (qEEG) frontal beta power, a biomarker for GABA-A receptor-associated anxiolytic activity consistent with GRX-917’s putative mechanism-of-action. Initiation of a GRX-917 efficacy study is anticipated in 1H23 with results expected in 2024. For additional details, refer to our January 19 note entitled Remains Focused on Advancing Broad Pipeline Following Recent Setbacks; Lowering Price Target to $20; Maintain Buy.

Mind Medicine; MNMD; Buy; $75 price target. MindMed ended 3Q22 with approximately $155M in cash and cash equivalents. This provides MindMed with sufficient capital to meet operating requirements through 1H25, well beyond Phase 2 proof-of-concept data in generalized anxiety disorder (GAD) and attention deficit and hyperactivity disorder (ADHD), which we believe remains underappreciated by investors. In 2023, we expect enrollment to begin for a Phase 1 study evaluating MM-402, the R-enantiomer of 3,4-Methylenedioxymethamphetamine (R(-)-MDMA), in autism spectrum disorder (ASD) which we believe provides important progress for the early stage pipeline. In late 2023, we anticipate Phase 2b top-line data in the program evaluating MM-120 (LSD) in GAD. We anticipate a positive outcome to provide additional clinical validation to LSD in anxiety and potential to broaden the pipeline. Also in late 2023, we expect Phase 2a trial top-line data in a program evaluating MM-120 in adult ADHD. We have low expectations for the ADHD program; however, a positive outcome would represent significant potential upside to our estimates. For additional details on MindMed, refer to our January 19 note entitled MM-120 on Track to Generate Phase 2 Data in Anxiety and ADHD Late in 2023; Reiterate Buy.

Cybin; CYBN; Buy; $10 price target. Cybin ended 3Q22 with approximately C$22M in cash and cash equivalents. A Phase 2a trial evaluating the safety, tolerability, PK, and pharmacodynamic (PD) of multiple ascending oral doses of CYB003, a deuterated psilocybin analog and Cybin’s lead candidate, in patients with major depressive disorder (MDD) is currently recruiting. This study has an estimated enrollment of 40 participants and an estimated primary completion date of July 2023 on clinicaltrials.gov. Additionally, in December, Cybin shared preclinical data for CYB003 supporting its progression into clinical development; the data showed: (1) CYB003 mirrors the in vitro binding profile and in vivo activity of psilocin and was safe, well-tolerated, and orally active; (2) CYB003’s effects on locomotor activity (LMA) closely mimic those from psilocin; (3) a dose-dependent increase in both blood pressure and heart rate occurred; (4) CYB003 exhibits a psilocin-like serotonin (5- HT) receptor binding profile, as well as similar off-target activity; (5) CYB003 exhibited less plasma level variability, a shorter time to peak levels (Cmax), and a shorter duration in rodents than psilocybin, which is the prodrug for psilocin. Separately, in June 2022, Cybin announced an agreement to acquire a Phase 1 trial evaluating DMT from Entheon Biomedical (ENTBF; not rated) to accelerate the development path for CYB004, a deuterated form of DMT, by approximately nine months. Cybin’s intention is to develop DMT for anxiety disorders. The Phase 1 EBRX-101 study has been renamed CYB004-E. We believe this compound, with a composition of matter patent in the U.S., could be successful going forward, based in part on support in the literature for psychoactive compounds in mood disorders, and also supported by the January 25 top-line data release from Small Pharma (DMTTF; Buy), which announced positive data in a Phase 2a trial that evaluated SPL026, an intravenous (IV) DMT formulation, in patients with moderate-to-severe MDD. Furthermore, we believe that the data from the SPL026 program should help inform Cybin on how best to proceed with its clinical program in GAD, and that the deuterated form of DMT could prove to have a more ideal PK and PD profile; we also note that CYB004 has a composition of matter patent in the U.S. Finally, we highlight pilot results released by Kernel, Cybin’s collaboration partner and a leader in non-invasive neuroimaging; specifically, on January 18, Cybin announced the feasibility study results provided important proof-of-principle for Kernel Flow as a portable functional system that provides real-time measurements of blood oxygenation changes in the brain associated with neural activity using time domain near infrared spectroscopy (TD-fNIRS). Although early stage, we believe the emerging data from Kernel could provide critical insights to the mechanism of action of psychoactive substances, potentially enabling optimized drug discovery in the mental healthcare space in the years ahead. For additional details, refer to our December 16 update entitled Compelling Preclinical Data Presented at ACNP Points to Potential Differentiation of CYB003; Reiterate Buy.

Numinus Wellness; NUMIF; not rated. As of November 30 2022, Numinus had a cash balance of approximately C$26M. Numinus is developing proprietary psychedelic-centered therapeutics products and has a clinic network, which expanded with the acquisition of Novamind, a mental healthcare company enabling safe access to psychedelic medicine through a network of clinics and clinical research sites, in mid-2022. Key benefits from the acquisition include: (1) expands Numinus’ operations and brand in the U.S.; (2) grows client programming as complementary service offerings would be shared and expanded across the combined network; (3) combines Novamind’s clinical research site management capabilities with Numinus’ research laboratory and analytical testing expertise; and (4) accelerates Numinus’ path to profitability. As a result of closing of the Novamind acquisitions, Numinus’ network has expanded to 17 clinics in North America and over 111 practitioners. Numinus clinics offer treatments with ketamine and psilocybin. We believe Numinus’ diversified mental healthcare strategy could be successful as Numinus expands its ecosystem of health solutions. This ecosystem is oriented around researching, developing, and delivering psychedelic-assisted psychotherapy; it comprises Numinus Biosciences, a Health Canada-licensed lab for psychedelic substance research, Numinus Health, which supports practitioners in delivering treatments by offering centralized, Numinus-owned training, facilities and other operational resources, as well as developing IP while offering analytics services for revenue generation.

Small Pharma; DMTTF; Buy; $2.50 price target. As of November 30 2022, Small Pharma had approximately C$23M in cash and cash equivalents. On January 25, Small Pharma reported compelling top-line data from a Phase 2a trial that evaluated SPL026, IV DMT, with supportive therapy in 34 patients with moderate-to-severe MDD. SPL026 was well-tolerated, and the study hit the primary endpoint, demonstrating a statistically significant and clinically relevant reduction in depressive symptoms at two weeks post-dose, as compared to placebo, while secondary endpoints demonstrated a durable treatment effect to 12 weeks. Detailed results are to be presented at upcoming scientific meetings and published in a peer-reviewed journal. Broadly, the results increase our confidence in SPL026 as it progresses to Phase 2b, and also increase our confidence in the potential for short-acting psychedelics as rapid-acting antidepressants. We believe the next expected potential positive event for Small is the advancement of SPL026 into a larger Phase 2b trial, which should keep Small in the lead among DMT-focused mental healthcare companies, in our view. For additional details, refer to our January 25 update entitled Short-Acting Psychoactive Compound SPL026 Demonstrates Potential in MDD Following Positive Phase 2a Trial; Reiterate Buy.

Mindset Pharma; MSSTF; Buy; $5 price target. As of 3Q22, Mindset had approximately C$8M in cash and cash equivalents. Lead candidate MSP-1014, a psilocybin analog that emerged from Mindset’s Family 1 drug discovery program, is to start Phase 1 development in 2023. Recall that in September 2022, Mindset received scientific advice from the UK Medicines and Healthcare products Regulatory Agency (MHRA) on a range of points to finalize its Phase 1 first-in-human clinical trial plan evaluating MSP-1014 for the treatment of MDD; CEO James Lanthier penned a letter to shareholders dated November 30 that noted the guidance from MHRA should enable “Mindset to significantly reduce the time and expense to progress to human clinical trials, bypassing additional preclinical safety studies usually necessary for this clinical transition, and allowing Mindset to proceed directly to treating patients. This first-in-human testing will allow Mindset to collect a valuable and wider range of human phase 1b/2a clinical data in patients.” We believe the Phase 1b portion of the program could generate initial data by the end of 2023, providing the first look at safety, PK, and psychedelic experience of MSP-1014. Also, recall that in preclinical studies, MSP-1014 demonstrated stronger 5-HT2A activity than psilocybin and attenuated reduction in locomotor activity, and has also demonstrated consistent body temperature at higher doses, which could indicate a potential safety advantage according to Mindset. Separately, on October 5, 2022, Mindset announced that after extensive preclinical screening studies, a lead psychedelic drug clinical candidate, MSP-2020, and a second back-up drug candidate, MSP-2003, have been selected from its Family 2 program in collaboration with Otsuka Pharmaceuticals (4578.T, not rated), to advance to IND enabling studies; importantly, MSP-2020 and MSP-2003 are both novel and patentable compounds; Phase 1 development is expected to begin in 2023. We believe this is important progress in the early stage pipeline with potential to have increased potency and efficacy compared to psilocin and psilocybin. Moreover, the lead compound(s) from Mindset’s Family 3 is expected to enter Phase 1 development as early as late 2023. We believe this could be important progress toward applications of subperceptual dosing. For additional details, refer to our November 17 2022 note entitled HCW “At Home” Recap: Reiterate Buy Ahead of Advancement of Lead Psychedelic Compound MSP-1014 to Clinical Development.

Reunion Neuroscience; REUN; Buy; $20 price target. As of 3Q22, Reunion had approximately C$21M in cash and cash equivalents. On January 9, Reunion announced promising interim data from a Phase 1 trial evaluating RE104 (4-OH-DiPT prodrug) in healthy volunteers. RE104 appeared safe and well tolerated and showed robust and pervasive PD effects with a shorter duration psychedelic experience of approximately three to four hours compared to the duration of six to eight hours with psilocybin. Reunion has continued with dose escalation and initiated an additional cohort in this Phase 1 study, which we believe demonstrates confidence in the safety of the compound. Based on the interim data, we believe RE104’s potency and pharmacologic profile appear similar to psilocybin though with a shorter trip duration, which could make RE104 attractive in the setting of a plethora of mood disorders such as depression and anxiety where psilocybin has also demonstrated potential. In 1Q23, we expect Reunion to have a pre-investigative new drug (IND) meeting for RE104 ahead of an expected IND filing to conduct a Phase 2 trial to evaluate RE104 in patients with PPD; we believe the Phase 2 program could begin enrolling patients in 1H23. Importantly, we believe initial data from the Phase 2 trial evaluating RE104 in PPD could be reported in 2024, de-risking the program, which remains highly underappreciated by investors. Furthermore, we believe these catalysts could impel important clinical progress for RE104, which we believe could become a differentiated therapy for PPD and potentially expand into additional depression indications such as TRD. Separately, in 2023, we anticipate a lead candidate to emerge from the RE200 drug discovery series, which are drug discovery candidates designed to have selective potency at the target 5HT2A receptors and are devoid of off-target 5HT2B receptor agonism. For additional details, refer to our January 19 note entitled Following Positive Interim Phase 1 Data, RE104 Nears Phase 2 in Postpartum Depression; Hires CMO; Reiterate Buy.